And the supporting role in the weight management category goes to supplements

As a result, some of the go-to natural weight management ingredients are losing market share to up-and-comers that either purportedly mimic the effects of semaglutide weight loss drugs (see #naturesozempic) or address the nutrient gaps and digestive issues left by suppressed hunger.

For those more attracted to a measured and sustainable strategy to weight loss—i.e., weight management—there are a growing number of natural metabolism-boosting, stress-reducing and satiety-inducing supplements to support a more holistic approach.

Supplement sales declining, ingredients emerging

According to market research firm SPINS, weight management supplement sales have declined over the past three years. For the four weeks ending Nov. 3, 2023, sales across the multi outlet and enhanced natural channel totaled $32.8 million, the lowest for any four-week period in the past three years. Year-over-year, the data shows that 2023 dollar sales in the category were down 6.1% to $174 million.

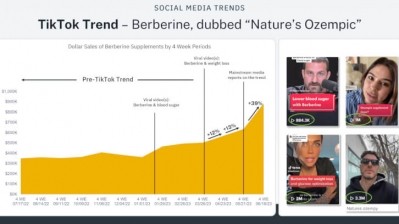

However, that does not necessarily mean that interest in weight loss has dissipated, SPINS noted in its 2024 Trends Predictions, but acknowledged that the booming category has been affected by elements like the Keto diet and the Ozempic craze, which has boded better from some supplement ingredients than others.

“As a result of trends coming from the pharmaceutical industry, blood sugar has taken precedence when it comes to the topic of hunger, satiety and healthy weight,” said Dustin Elliott, senior brand manager at The Vitamin Shoppe. “Currently, berberine is the hottest trending ingredient in this category.”

“The Vitamin Shoppe is partnering with suppliers to bring a more bioavailable form of berberine to the market,” he added.

Berberine, which has been riding the wave of its new-found “Nature’s Ozempic” social media identity since January 2023, saw a 940% jump in sales at the peak of its hype from the four-week period prior, according to SPINS. Within the last year, berberine sales increased 95.6% to total $7.6 million.

The botanical extract has been found to influence the release of leptin and ghrelin, two hormones involved in hunger and satiety. By modulating these hormones, it may help to reduce cravings and reduce caloric intake. Although the National Institutes of Health says the data is yet inconclusive, a 2022 review published in the journal Frontiers in Nutrition found significant decreases in both weight and BMI in people who took berberine, with effects on weight more pronounced at a dose of at least 1 g per day for more than eight weeks.

This month, health and nutrition retailer GNC launched GNC Total Lean GlucaTrim as a “safe, affordable and holistic alternative” to Ozempic and its associated cost and risks “to support weight loss, manage blood sugar levels and preserve lean muscle mass”. The “multi-action” formula combines Chromax chromium picolinate, the Slimvance herbal blend of moringa, curry tree leaf and turmeric, Reducose white mulberry leaf and Indian barberry (standardized to 75% berberine).

What consumers are buying

Neil Levin, CCN, DANLA, senior nutrition education manager at natural product manufacturer NOW, told NutraIngredients-USA that the company is seeing some small growth across a variety of weight management products. He shared a list of NOW-branded products that feature thermogenic, stress, fat-binding, blood sugar and satiety supporting ingredients as standalone products or synergistic component in combination formulas sold as compliment to a healthy diet and exercise.

“Relora [a blend of Magnolia officinalis and Phellodendron amurense herbal extracts marketed for appetite control] continues to do well for us; aside from weight management, it also supports the body’s stress response, which has been a trending category for a few years now and has helped maintain steady sales,” he added. “Chitosan and Apple Cider Vinegar continue to be staple products for us in this category as well.”

According to SPINS data, cider vinegar supplements saw the greatest gains year-on-year, with sales up 57% to $13 million for the 52-week period ending Dec. 31, 2023. Other performing ingredients included herbal formulas (up 10% to $10.8 million) and fenugreek (up 10.5% to $4.8 million).

Although overall sales are down from a year ago, caffeine and green tea continue to lead the category with the most dollar sales, registering $44 million and $14 million, respectively. Glucomannan, ketones, goji berry, chromium and the folic acid-B6-B12 combo round out the top 10 functional ingredients in VMS weight management formulas.

Scott Dicker, market insights director at SPINS, said that although not necessarily reflected in the data, there are a few other promising ingredients.

“Reducose is one to watch that hops on the blood sugar support trend that we are seeing with established ingredients like berberine,” he said. “Additionally, with the rise of GLP-1 drugs, I look for much of the category to shift to adjacent areas of support. This includes things like greens supplements, multivitamins and protein powders to fill in nutrient gaps.”

Adjacent areas of support, amping up efforts

Meghan Martens, senior buyer at The Vitamin Shoppe, said that it’s impossible to talk about weight management without touching on the effects of the growing trend towards pharmaceutical options.

“While this brings changes to this category, The Vitamin Shoppe offers products to support customers on these new weight management journeys, such as vitamins D or B12, magnesium, electrolytes and protein powders,” she said.

For customers who are less interested in “magic pill” formulas and are long-time shoppers of the category, The Vitamin Shoppe shared that single ingredients like conjugated linoleic acid (CLA) and L-Carnitine are still top sellers and that brands with loyal customer bases like fat burner OxyShred continue to do well with the growing high-stim set.

“Thermogenics have been strong in the category as consumers are looking to get more out of their workouts,” Martens added. “Our customers are aware of the time and dedication necessary for a fit lifestyle, and our thermogenic options give them a way to amp up those efforts.”

Fat-burning thermogenics are also popular at GNC, with the new Performix SST X thermogenic joining metabolism-boosting mainstays like green tea extract (appearing in GNC’s Total Lean Appetrex and Nugenix Thermo X) and CLA to support body fat loss and lean muscle mass gains. Its Total Lean line also includes meal replacement shakes, protein-packed snack bars and Total Lean 60 Burn, a thermogenic formula with guarana, black tea, ginger root, dill weed, and grape skin and seed extracts.

In terms of the future of the category, Gwynne Maiorana, director of merchandising for weight management, herbs & greens, and health & beauty at GNC, said that natural ingredients, personalized formulas and probiotics for gut health will find favor with increasingly conscious consumers in search of quality, transparency and sustainability.

“The quest for quick and convenient weight loss drives consumers to supplements,” she added. “Promises of boosted metabolism, appetite suppression and effortless fat burning ignite their motivation. But losing weight is rarely a smooth ride.”

No magic bullet, no one-size fits all

Part of the evolution of the category is the positioning of a more holistic approach to consumer demands beyond the weight management aisle to cater to the related health and wellness needs of individual customers.

“Consumers should know that weight management products are not one-size-fits all and that results are not going to happen overnight,” Martens said. Elliott added that in The Vitamin Shoppe’s view, supplements should be used as aids to support a weight management plan tailored to caloric consumption and physical activity.

NOW’s Levin said healthcare providers will of course advise “a comprehensive diet and supplement plan rather than relying on ‘magic bullet’ single products." However, he suggested that consumers look at four categories of weight management products in the NOW portfolio to accompany them on their weight loss journeys: fiber supplements like glucomannan to cut appetite; the Diet Support thermogenic formula; Adrenal Stress Support with Relora to curb stress-related eating; or the Phase 2 carb controller formula with white kidney bean extract.

“Today’s youth-obsessed media and influencers make people want to look young and fit well past middle age,” he added. “There are no shortcuts to health, only natural aids to good health. The very visible failures of both diet drugs and illegal products pretending to be dietary supplements illustrate the depth of the market and the need for effective natural weight management products.”